Give Me 20 Minutes and I’ll Show You How We Can Build a Property Portfolio Backed by Real Infrastructure Data — Matched to Your Budget, Goals, and Risk Profile.

The Smart Way to Identify Growth Markets Won’t be found on the hotspot hype lists...

Former ‘Big-4’ Valuer Breaks Silence On The "Follow The Billions" Method For High Growth Locations Based On Actual Infrastructure Spending... Not Hopeful Market Guesswork

GET 3 LOCATIONS WHERE THE INFRASTRUCTURE MONEY IS FLOWING THAT ARE PERFECT

FOR YOUR INVESTMENT BASED ON YOUR BUDGET AND GOALS

WARNING

Do NOT buy another so-called 'hotspot' and here's why...

Most investors are being guided by outdated data and surface-level trends.

Those areas often look promising after the real growth has already occurred.

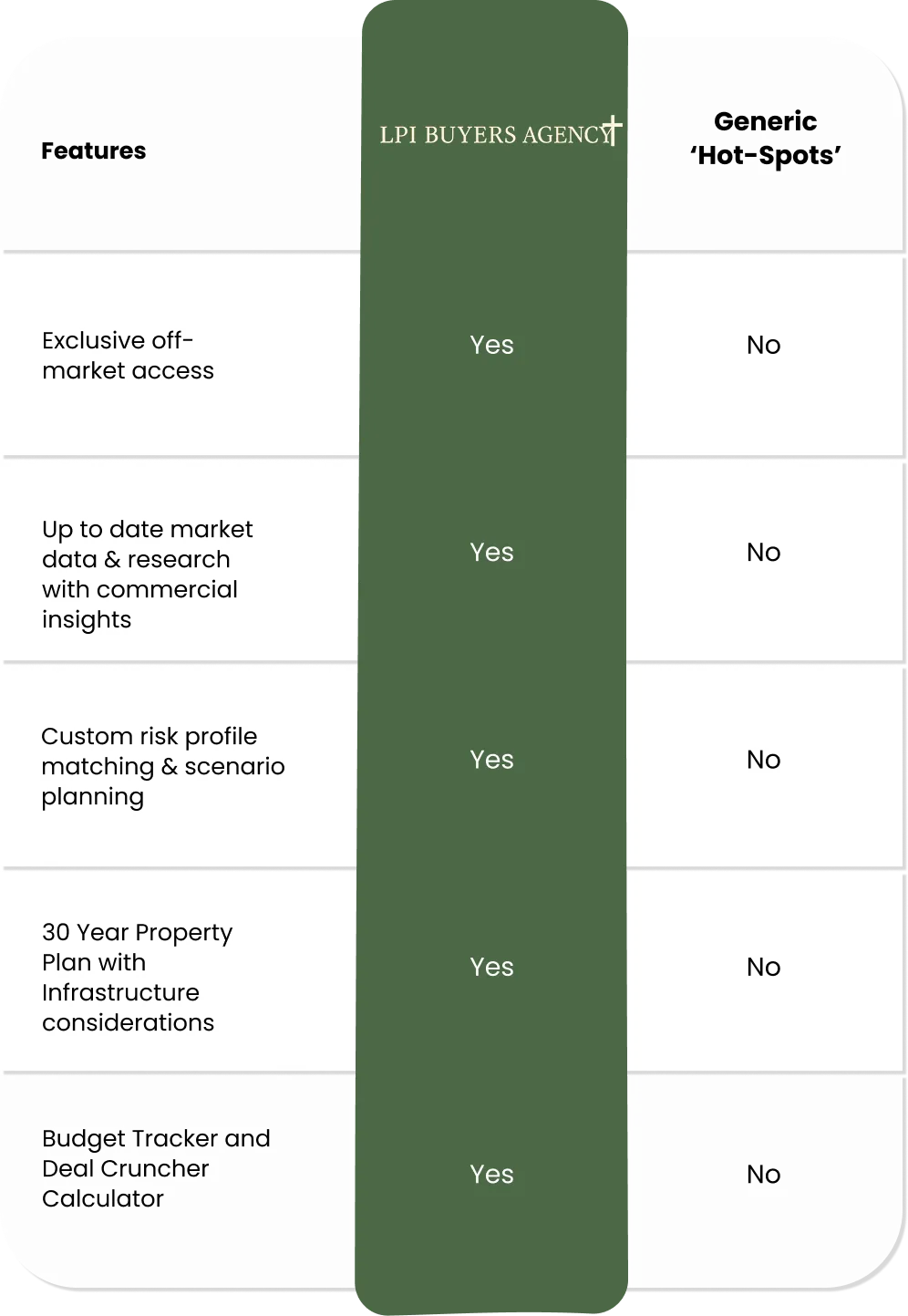

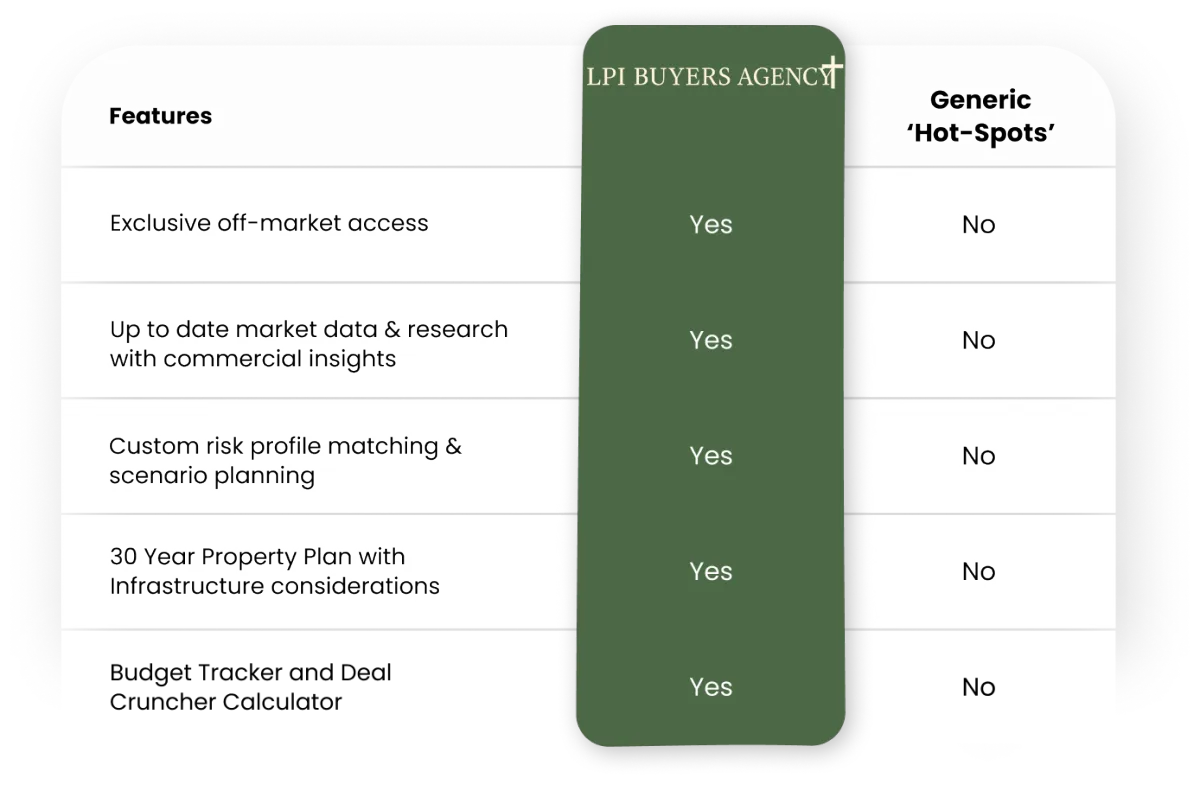

At LPI Buyers Agency, our approach is different.

We analyse real-time infrastructure spending, population movement, and economic investment patterns — identifying the markets positioned for sustainable, long-term growth.

I’m Melvyn Romit.

A former property valuer with 9+ years of experience, including 4.5 years at JLL.

Using that background, I built a $3.5 million property portfolio 10× faster than the average investor — by focusing exclusively on where capital investment is already driving transformation.

I call it the Infrastructure Intelligence System.

It’s how I find growth areas backed by real money — not market noise.

Drawing on my background in commercial valuations, where I assessed billions of dollars in assets across luxury hotels, residential developments, and commercial properties nationwide.

I use the same analytical discipline to identify where government and private capital are actively reshaping demand.

This isn’t speculation or “market sentiment.”

It’s measurable growth driven by confirmed infrastructure spending — projects that inject jobs, housing demand, and long-term value into local economies.

While many investors chase short-term trends, I focus on positioning ahead of the curve — entering markets before the impact of infrastructure spending is fully priced in.

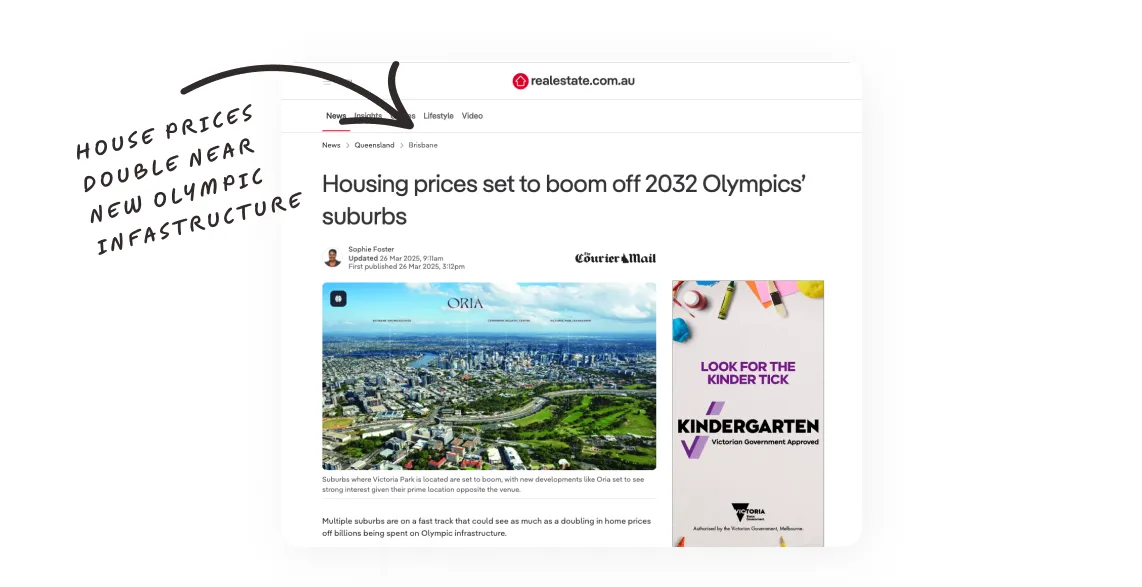

For example,Realestate.com.au projects that Brisbane’s housing prices will surge off the back of billions being poured into Olympic infrastructure.

House prices aren’t just “rising” — they’re reacting to confirmed government investment.

This isn’t a trend.

It’s the transfer of infrastructure spending into capital growth.

And it’s not just Brisbane.

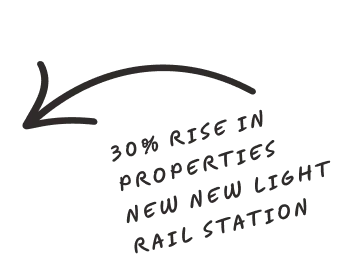

Griffith University research found property values jumped over 30% near new Gold Coast light-rail stations..

This is not intangible guessing.

This is understanding where the money is already flowing and making your move at the right time.

And so here's my offer to you...

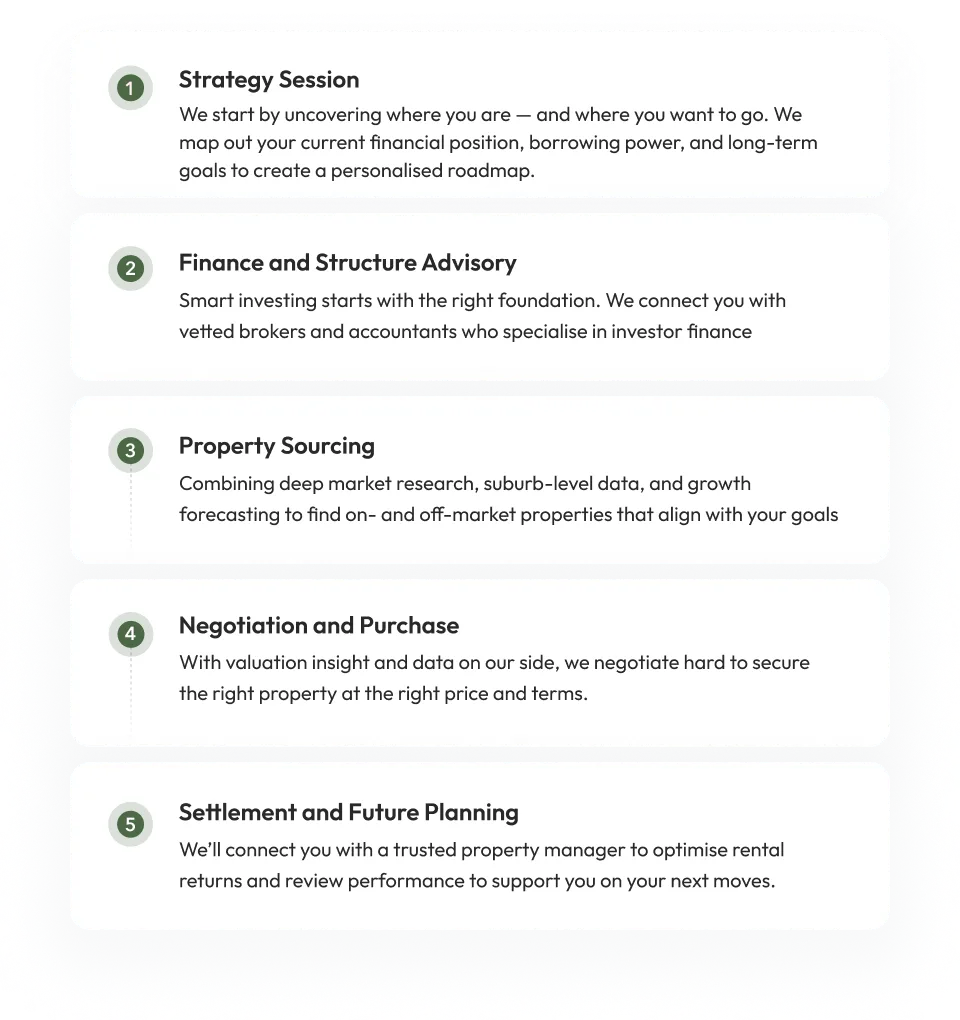

A 20-minute private strategy consultation to review your goals, budget, and investment timeline — and outline how this system applies to your situation.

If you want me to move forward and handle the deal for you , plan your investing roadmap and save you time, stress, and money... you’ll be set up for guaranteed success.

If not... you’ll still leave with absolute clarity on the metrics that matter most — and how to assess markets through the lens of real infrastructure spending.

The Infrastructure Intelligence System I Used to Build My Multi Million Dollar Portfolio

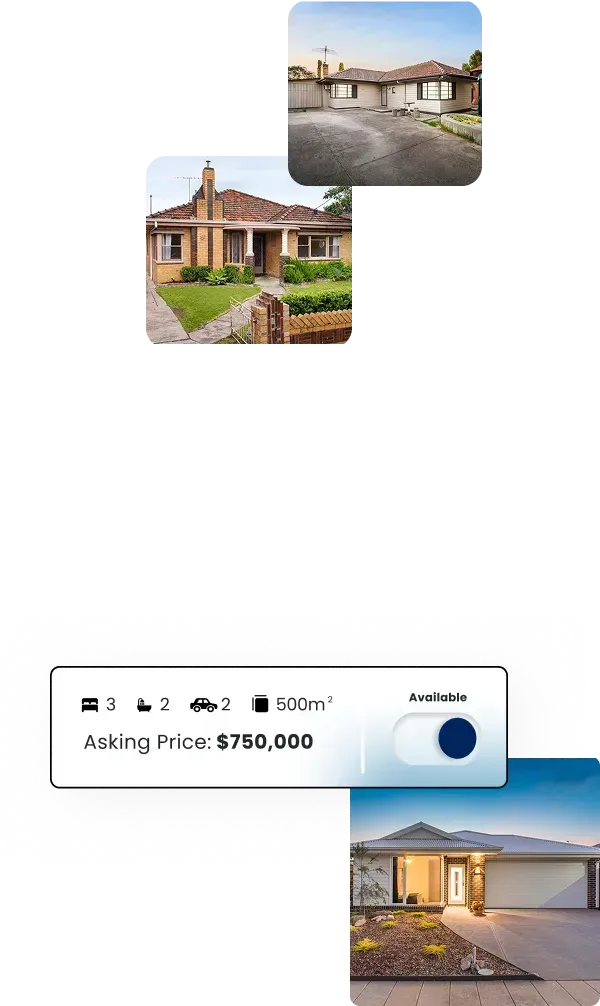

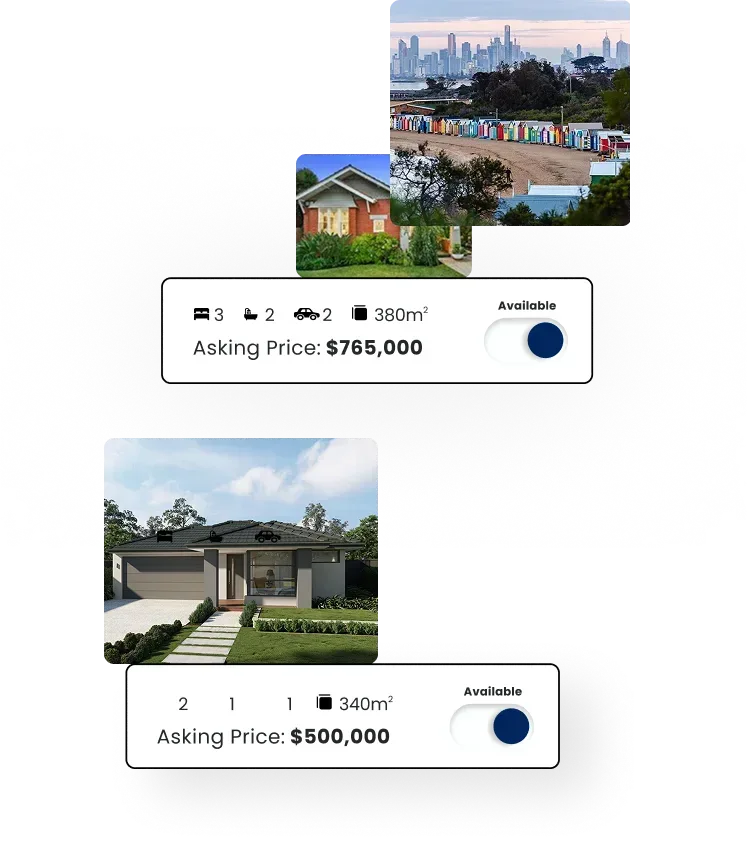

Access Strategic Growth Locations

Backed by Real Infrastructure Spend

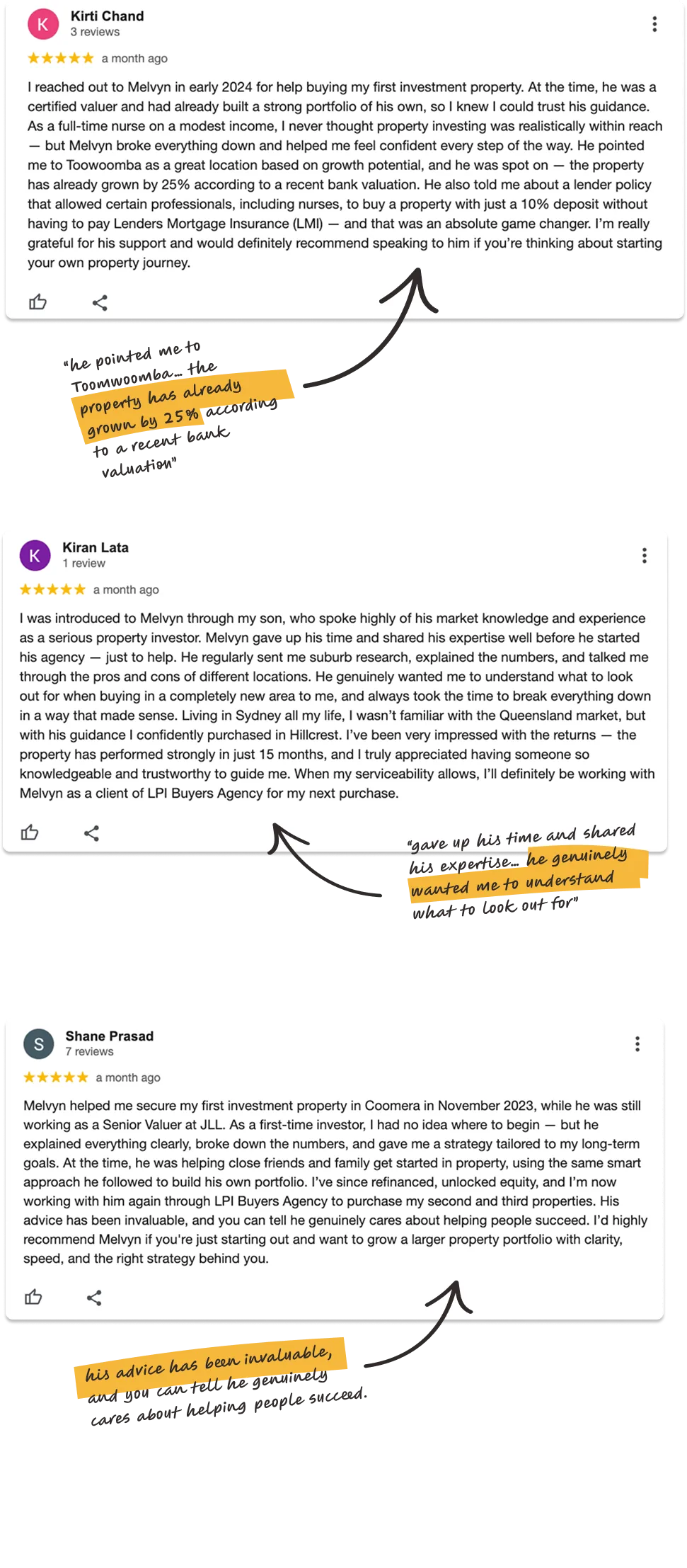

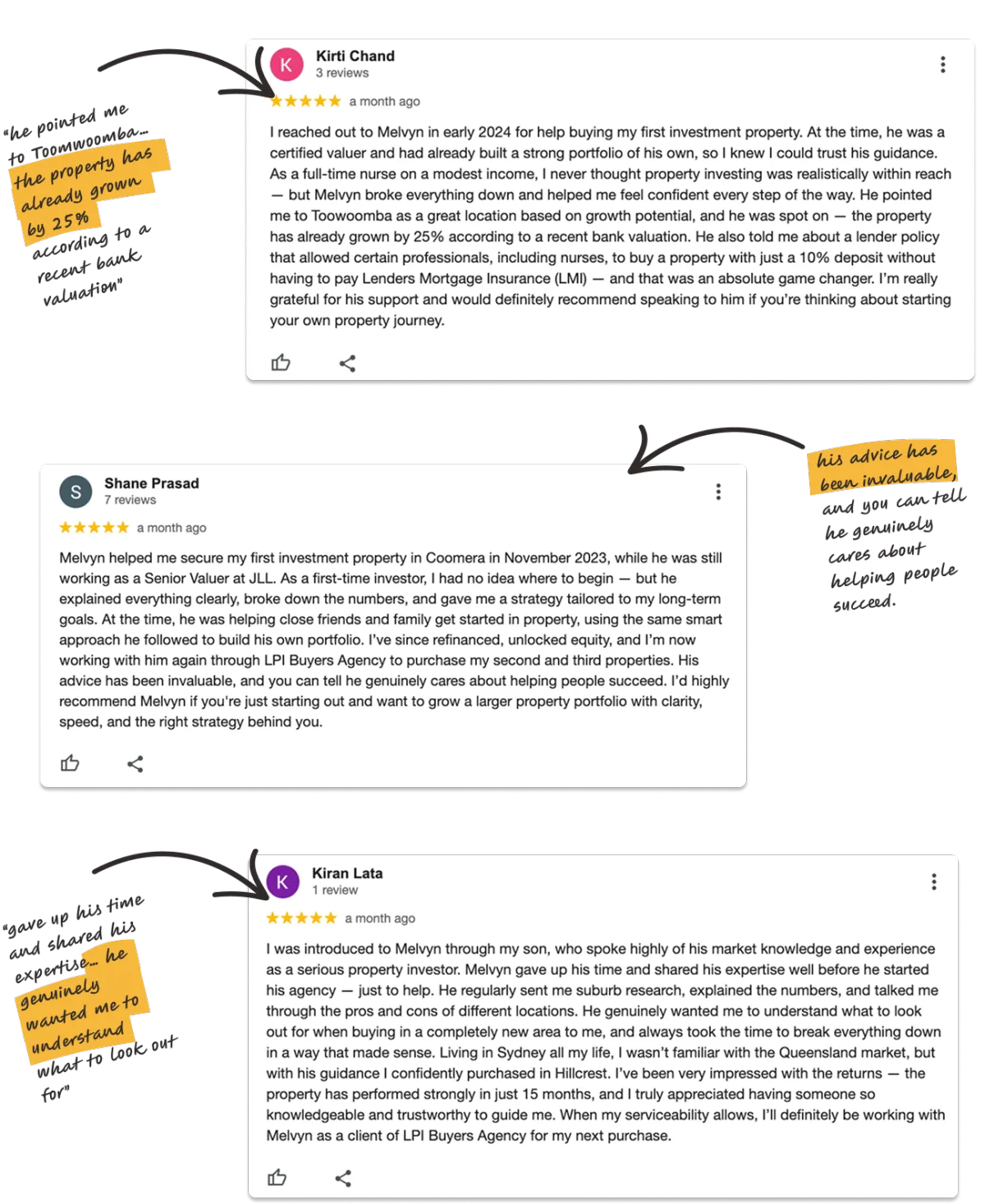

Hear From Investors Who Trusted

Us To Build Their Portfolio